Business & Tax in Focus app for iPhone and iPad

Developer: SoundCartel Pty Ltd

First release : 08 Jul 2018

App size: 55.01 Mb

These two audio series, "Business in Focus" and "Tax in Focus" are the most convenient way for accountants to keep abreast of essential tax changes and receive practical business advice.

Let CPD come to you! You can now earn valuable CPD while listening in the car, at home, at work or on the go.

Approximately two hours of new essential audio is added each month (December/January combined).

Each month we interview business experts who provide succinct advice on a range of issues of importance and relevance to you, your practice and your clients. All audio is practical, engaging and entertaining.

Produced in a state-of-the-art recording studio, with a dedicated team of producers and journalists, the quality is of audio and content is second-to-none.

Thats why thousands accountants have chosen these audio series for more than two decades to keep up to date on tax changes and on the very best advice for running a successful practice.

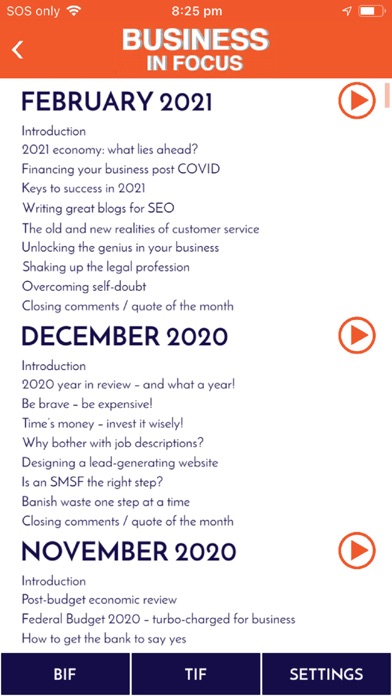

"Business in Focus" is full of practical information that you and your clients can implement immediately to help increase the bottom line. Youll hear expert advice on professional accounting issues, plus topics including:

- The economy

- Broad-based business issues

- Success stories

- Leadership and HR issues

- Personal development

- Marketing and sales strategies

- Legal watchouts

- Technical updates

- Sharemarket updates

- Interviews with some of Australias most interesting business operators

"Tax in Focus" is presented by expert speakers from the Chartered Accountants Australia and New Zealand specialist tax training team keep you up-to-date on tax issues with a focus on key changes and their practical impacts.

We focus on the key issues so you arent bogged down in technical detail. Our format is designed to make the key issues stand out and our sessions are concise and to the point and broken into discreet and digestible segments.

Topics include:

- Legislative changes

- ATO announcements and new rulings

- Court cases

- Consolidation

- Superannuation

- FBT

- GST

- Tax administration